This letter reveals…

How Singaporeans Convert Their HDB

or Condo Into A “Payday” Of 667K+ Every

5 Years And Retire Before 60 With 4M More In their Retirement Portfolio And A Dream Home That's Fully Paid

How Singaporeans Convert Their HDB or Condo Into A “Payday” Of 667K+ Every 5 Years And Retire Before 60 With 4M More In their Retirement Portfolio And A Dream Home That's Fully Paid

Add an extra $4M to your retirement WITHOUT taking on any

extra work, trading your time, or changing your lifestyle…

Add an extra $4M to your retirement WITHOUT taking on anyextra work, trading your time, or changing your lifestyle…

Dear Readers,

My name is Damien Tan, and I’m a Senior Associate Director at Propnex Realty.

My team and I have helped 813+ “Ordinary” Singaporeans with HDBs or Condos get on route to retiring years ahead of others, with an additional 4M or more in their retirement portfolio…

I realised that many of us locals are actually not aware that turning our first home into a “money-making machine” that helps us achieve retirement sooner with a fully paid off dream home, is possible.

This is why, In this letter I decided to go through how many of my clients are able to:

Retire with 7M or more in their retirement portfolio before reaching 60…

Get a fully paid off dream home in the process…

And have the financial freedom to live exactly the way they want at 53…

Not only that, I will also go through frequently asked questions and common misconceptions about the property retirement market in Singapore:

Why should I sell my house now instead of waiting for prices to rise even more?

My home is just a place to live, not something meant for investment right?

Property is only something ‘experts’ can do, I don’t think my spouse and I can handle this?

How exactly do I make money from selling and upgrading property?

Why property? Not stocks, insurance, crypto or forex?

Just to be completely transparent, the Property Flywheel Cycle™ strategy I am about to discuss will NOT work for everyone.

This only works for individuals with 500K or more in cash or CPF available after selling their home, here’s what I mean:

You sell your house for 750K (I’ll show you how to get an extra 50K-60K from this later in this letter)

You’ve owe the bank or HDB 200K

200K + 20K (for misc legal fees) = 530K cash into your pocket

The CPF you used for your old house goes back into your account, example 180K

530K cash + 180K CPF = 710K available for you

This leftover fund I just explained is ESSENTIAL for our strategy to work. And If you’re in that position, I assure you…

This short read will greatly benefit your life.

Real Outcomes From Real Singaporeans

From Years of Uncertainty…

To Full Confidence in One Consultation.

I have been watching the market for years but was always afraid of buying at the peak.

Damien’s team changed everything.

He didn’t just show listings, he gave strategic, data-driven guidance tailored to his exact worries.

His patience, professionalism, and clear breakdown of risks, trends, and opportunities removed all uncertainty.

They Sold My Unit in 2 Weeks And Helped Me Secure My Next Home at Low PSF.

He struggled to sell due to noise issues and had agents fail him… until Damien’s team stepped in with a clear, strategic plan.

They sold his unit fast at a strong price, then guided him to choose the right development without rushing even with other buyers competing.

With data-backed advice and consistent updates, the entire journey was smooth and confident.

Secured an Undervalued Unit Without Missing a Single Opportunity.

The process felt complicated: removing a name from the family HDB, planning an upgrade, and trying not to miss good deals in the market.

They guided every step clearly, handled everything efficiently, and secured a below-market-value unit.

With clear advice, data-backed analysis, and a proactive team always one step ahead, the entire journey was stress-free.

73% OF OUR CLIENTS SOLD THEIR HOUSE AT

RECORD PRICES (60K+ MORE) AND FAST-TRACK

THEIR FINANCIAL GOALS BY 13 YEARS

73% OF OUR CLIENTS SOLD THEIR HOUSE AT RECORD PRICES (60K+ MORE) AND

FAST-TRACK THEIR FINANCIAL GOALS BY 13 YEARS

Contrary to popular belief, holding onto your property any longer wouldn't actually increase its price (94% of time).

Each year you hold onto your property…

Each year you tell yourself “maybe next year”…

Each year you delay this decision…

You would be losing both time and PROFIT, a whole lot of it.

Most of us believe that our home is just a place to live in, nothing more – And I don’t completely disagree.

But if leveraging your first home could propel you into retirement sooner, and add millions into your portfolio WITHOUT taking any extra effort or time from you, wouldn’t it make sense to take the next step?

That 4-5 room HDB or 2 bedder condo you currently have is actually enough to get you started on a compounding journey,

It’s enough to retire you YEARS ahead of everyone.

The Truth Is Simple:

You don’t get rewarded for waiting.

You get rewarded for taking the right action, at the right time.

If your house valuation is high today (will be discussed on our assessment call)…

If buyers are willing to pay more…

If the market is still holding strong…

Why risk losing 170K or more in cold hard PROFIT to uncontrollable factors like cooling-measures and market cycles?

Here’s what many clients realise after our first assessment call:

- The risk of not selling their property and opportunity cost they’re missing out is NOT worth it. This one step at 30+ could DRASTICALLY change their life now, and the future.

Here’s a recent case study of 7 different clients making 400K profits in just 1 year (average 400K profit only happens after 4-5 years…)

7 Clients Made 400K

in 1 Year Using our Undervalue Property Spotting Method – 2.8M In Cold Hard PROFIT

After helping hundreds of clients sell their house for record-breaking prices, we will help them scout and survey the entire Singapore market for undervalued property.

In other words…

We find the next “soon to be” Sentosa Cove project

Get it for a good price before the market realises this opportunity

Sell this high-appreciation property with 500K-700K profit.

This step has made HUNDREDS of clients millions of dollars.

And this is just step 2 of our “flywheel cycle” strategy…

Usually Skeptical When It Comes To Agents But Damien & Team Is Really Trustable, Would Highly Recommend.

Really Couldn't Have Done It

Without Team JNA, Thank You!

I Think Damien Predicted And Understood The Numbers Better Than Any Agent I Met

He Helped Us Sell Higher

Than We Expected And Guided

Our Next Move Clearly

I am not one who doesn't do what I preach,

The exact property I scouted for my clients above, I bought it too, here’s proof:

Our strategy works because I put my own money into deals I recommend, I too have “skin in the game”

The ‘Undervalue Property Spotting Method’ AND ‘Property Flywheel Cycle™’ I talk about is proven, and it works wonderfully.

You do NOT have to “gamble with the market”,

Or ‘hope that the market doesn’t crash’ with our system

This is a cycle that has worked again… and again… and again.

This is exactly how many Singaporean couples – managers, bankers, young families – build million-dollar retirement portfolios without taking any crazy risks or working 3 extra jobs.

Here’s more proof…

TESTIMONIALS

Real Outcomes From Real Singaporeans

Real Outcomes From

Real Singaporeans

We viewed 20+ units on our own… but only found the right home after Damien stepped in.

They spent weeks viewing units on their own, constantly losing out to faster buyers and feeling overwhelmed by the whole process.

Damien stepped in with clear comparisons, data-driven analysis, and guidance they had never experienced with any other agent.

He narrowed the options quickly and helped them secure an undervalued home that has already appreciated.

We were scared to sell… but Damien planned everything and sold our home at a record price.

They hesitated to sell, worried about affordability, interest rates, and whether they could find a better home after letting theirs go.

He planned everything, budgeting, timelines, and the full selling-and-buying process giving them complete clarity and confidence.

Their home sold in three viewings at a record price, and he still secured their next home within budget.

We never planned to move but Damien helped us upgrade to freehold, sell at a record price

They feared selling their 99-year home wouldn’t allow them to afford a freehold property in the same area for their family.

Damien stepped in with fast guidance, deep local knowledge, and clear reassurance, mapping out the upgrade strategy.

He sold their unit ahead of schedule at a top price and secured a freehold home that has already appreciated.

Why Is This “Recession-Proof”

And What Prove Do You Have?

Why Is This

“Recession-Proof” And

What Prove Do You Have?

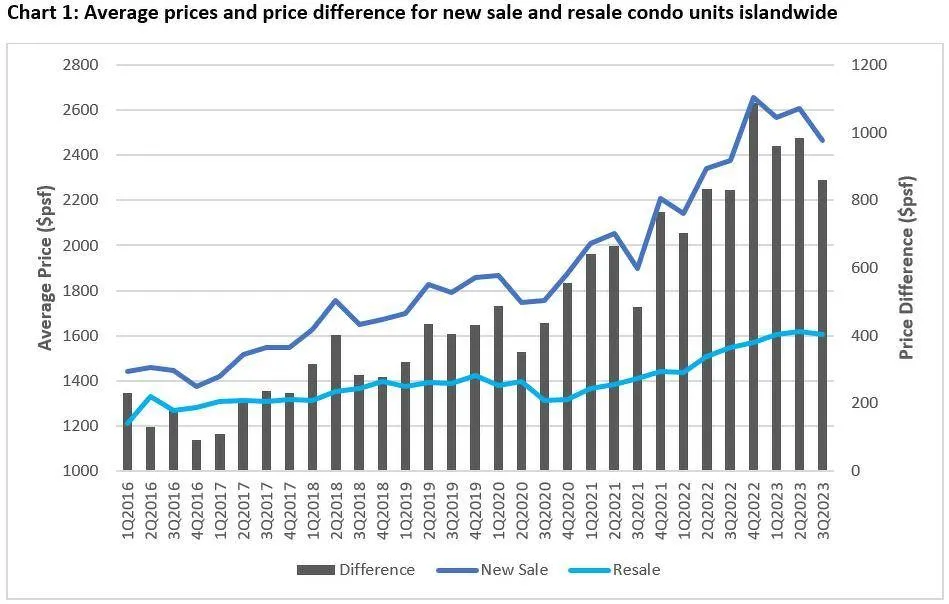

Our clients are getting an average return of 19.65% throughout the last 4 years, this means that their money is beating inflation, banks, and many major investments out there.

For further context, banks only offer a 1.5% return…

Even if you have the most exclusive and premium bank savings account, the highest you could ever get is 7.43% in returns (as of December 2025)

Property is beating that percentage by 12.22%-18.15%

Our client money (including myself) is growing at a Stronger, and more STABLE rate than most traditional options or alternatives like stocks, crypto or forex out there.

Yes, a 40% or 60% return on things like stock and forex trading is possible in a single day.

But are you willing to go through the hassle of learning these things from scratch, and managing multiple portfolios at the same time for the next 30 years?

The reason why most Singaporeans prefer

property instead of these options for long-term

wealth and retirement investing is:

The Reason Why Most Singaporeans Prefer Property Instead Of These Options For Long-Term Wealth And Retirement Investing Is:

It Is Predictable

Property values in Singapore don’t swing wildly like crypto or forex.

The Market Is

Tightly Regulated

Government policies keep the environment stable, reducing the kind of chaos you see in high-risk markets.

It Is Backed By Something Real

A physical asset in a land-scarce country is safer than charts and

candles flying up and down.

It Creates Long-

Term Security

Property is seen as a legacy tool, something you can pass down, not just trade for short-term gains.

Year-Round

Tax Planning

Proactive tax planning strategies throughout the year, so you’re always ready for tax season.

It Gives You

“Passive Income”

Rental demand in Singapore is consistently high, so the property doesn’t just grow in value, it can pay you every month.

Here’s An Example Of How Some Singapore Property Held Up During Covid-19

Parc Esta is a project launched in late 2018 (2 years before covid) along Sims Avenue, in District 14.

As you’re aware, when Covid hit in early 2020… The entire world froze, markets crashed, companies downsized, and property in most of the market outside of Singapore tumbled.

BUT, A typical 2 bedder that launched around 1.24M in Parc Esta, was transacting at 1.45M to 1.5M during Covid. That’s a 400K to 550K jump during a global crisis.

And today… You’re seeing units from the same project selling for 1.7M to 1.8M without any struggle.

Just to be clear, NOT all property spike or maintain price during crisis.

It takes real experience, and countless amounts of property spotting to secure yourself a “recession-proof” and secure retirement property investment.

The market in Singapore wins because, even during one of the biggest disasters in modern history, the right projects still climbed in price.

They appreciated and protected every single dollar of investor money inside.

This is the kind of project we scout for clients, ourselves, and you. Recession & Cooling measure proof projects with high potential gains and real demand in the market.

If you’re between 30 to 35 right now:

This period of your life controls everything that happens for the next 20 to 30 years.

This is the age where you still have enough time to run multiple 5 year cycles properly… Just one smart move can compound into a few million dollars into your retirement portfolio without putting in any extra work.

As I mentioned earlier, your first property is not just a place to stay, It’s the strongest financial tool you own here in Singapore.

It is the ONLY asset that can unlock 500K or more in liquid usable capital without sacrificing lifestyle or without exposing yourself to high-risk investments.

This is how you retire before reaching 60 with a fully paid dream home and the financial freedom to live exactly how you want…

I’ve seen couples make one correct move at 32 or 33 and end up 4M to 5M more in their portfolio by the time they hit 58.

At this age, the danger is not making a mistake… The danger is assuming you have time.

And just as I’ve explained just now, It’s not about timing the market, It’s about timing your life.

When it comes to trust…

I never expect anyone to give it upfront.

Most of my clients only decided to work with me after they saw the track record for themselves.

My team and I have helped over 813 Singaporean couples fast-track their retirement by years… sometimes even decades.

My work has been featured on:

✅ CNA

✅ The Straits Times

✅ Yahoo Finance

✅ AsiaOne

✅ Money FM

Because the results are real, consistent, and repeatable.

We are also ranked number one in PropNex (JNA Real Estate) and we’ve sold more than 3000 homes – where most of them were sold at 70% to 80% HIGHER than the industry average.

All of that is just some background to ease your concerns, here’s the part that truly matters…

I personally put my own money into the same undervalued projects I select for clients.

I don’t recommend anything I wouldn’t buy myself.

This is NOT based on theories or guessing.

If I tell my clients that a project is undervalued…

If I tell my clients that it is recession-proof…

If I tell my clients that it has a strong upside…

It means that I’m willing to fork out my own cash inside it too.

I don’t gamble with my client's future, and I don’t hide behind silly presentations.

Everything my team and I suggest is structured, proven, and built to protect their money first… then grow it steadily cycle after cycle.

TESTIMONIALS

Real Outcomes From Real Singaporeans

Real Outcomes From

Real Singaporeans

Damien guided us into a smart upgrade plan that helped us secure two properties with confidence.

He broke down the numbers clearly, filtered the right homes, and stayed responsive throughout.

Now we have a family home and an investment property.

Damien gave honest guidance from Day 1 and helped us make the best long-term decisions

He handled the staging, marketing, viewings, and all the calculations needed for each option.

We sold confidently and secured two properties that fit our long-term goals.

Damien used clear data and analysis to guide us and helped us secure the right home with ease.

He explained the market clearly, filtered only suitable units, and coordinated everything smoothly.

The process was fast, efficient, and supported by his lawyer and banker network.

How The Property Flywheel Cycle™ Works:

1. Sell your current property at the highest possible price

This is the most important step because it controls the capital you can use for the next 10 to 20 years.

My team and I specialise in breaking record prices inside your estate.

73% of our clients sold at record numbers, that’s an additional 60K to 80K more in profits compared to the market

This is how we unlock 500K to 800K in usable capital needed for your Flywheel Cycle to begin.

2. Secure 1 to 2 undervalued recession-proof condos

Instead of buying a random project your friend recommended…

We go into the market and pick units with:

Strong fundamentals

Real demand

Low supply

Tight pricing gaps

And a clear growth runway for the next 5 years

This is how clients consistently get 500K to 700K gains within each cycle.

This is also how 7 of my clients made 400K each in a single year recently…

3. Grow and position yourself for the next exit

You don’t need to monitor everything every day.

You don’t need to watch charts or guess when the market is going to crash.

You let it appreciate and we do the monitoring for you.

My team and I will track:

The numbers

The demand

The policies

And the exact timing to list your property again at a profitable exit.

4. Repeat the 5-year cycle until you reach your dream home and retirement goal

Every 5 years, your portfolio gets bigger and more powerful.

By your late 40s or early 50s…

You end up with:

A few million in gains

A fully paid dream home

And the choice to retire early while maintaining a lifestyle your younger self would have never imagined.

Most couples are shocked when they realise they can achieve this without working harder… without changing their lifestyle… and without taking any risky investment paths

What You Need To Understand…

Most Singaporeans don’t even realise that their first property can unlock this kind of financial power for them.

You already:

✅ Own an appreciating asset

✅ Have age on your side (30 to 35)

✅ Have capital sitting inside your home

This window does NOT stay open forever.

If you:

❌ Wait too long…

❌ Let cooling measure hit…

❌ Hold onto your house until the market stagnates…

❌ Or only start planning after 40…

The entire Flywheel becomes harder to execute, and your results get smaller.

The couples who win understand one thing clearly:

You don’t get rewarded for waiting, you get rewarded for taking the right action, at the right time.

The proof is already there:

✅ 813 clients following this system

✅ Average annual gains of 19.84% over the cycle

✅ Multiple record-breaking sales in different estates

✅ Million-dollar outcomes across multiple 5-year cycles

✅ Clients retiring years ahead of others simply because they acted earlier in life

If you want a retirement plan that actually works for Singaporeans…

This is the exact path we use again and again.

How To Find Out If This Will Work For You

If you want clarity on whether the Flywheel Cycle will work for you…

The next step is simple.

Book a short 20 minute “Property Mapping Session” with me.

During our call, you will see:

How much usable capital you can unlock today

Whether your property can fetch a record price in today’s market

What kind of undervalued projects fit your goals

How your retirement could look if you start the cycle now

Whether you can realistically reach an extra 4M to 5M by 50 to 60